Nov 15th Bubble News Update

IndyMedia Nov 13th: Low yields turn off Irish Property Investors

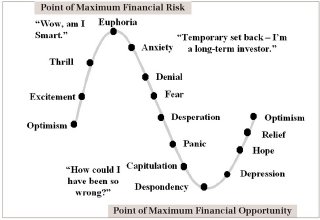

Where do you think we are on this cycle?

October 2006, cracks are forming in the Irish residential property market. This blog will list and comment on price drops. How to find examples: search a property site, then google the same listing and check the cached pages - and don't forget to post them here!

IndyMedia Nov 13th: Low yields turn off Irish Property Investors

5 Comments:

I wouldn't think of indymedia as an anarchist type media service as being the best for predicting capital confidence, but they are surprisingly accurate in this simplified graph. We are in-between euphoria and anxiety at the moment, but Ireland is a rather unique economic entity and while trends are good for predicting it is very important to consider the items that make Ireland's current economic situation unique:

1. massive immigration. Even with a crash by Irish standards, the situation here is still a lot better than that in the native countries of many immigrants, so this lower paid workforce (rightly or wrongly) will most likely stay - at least the 60-70% at a guess, so there will still be a vibrant workforce that will most likely fuel an increase in different areas of the economy and continue the demand for housing.

2. Urban sprawl. With the exception of LA in the USA, there are few cities where actual land space is so badly used and urban sprawl is so terribly evident as Dublin, and as such the demand for land will continue, especially as most is held by a handful of developers who have a MAJOR vested interest in continued high property prices.

3. Small population. Because Ireland has an extremely small economy, massive crashes on the scale and speed of other economies where there have been crashes in property (London, Tokyo) the impact is unlikely to be as fast, nor as disastrous. Word travels fast in Ireland and opinions change overnight from simple things like Chris Barry phone show, Eddie Hobbs, or the popes children most recently.

So, I think the hype over impending crash are overinflated themselves, like the house prices, and in fact there will be a leveling out, a small crash, and then another levelling out and so on. The biggest drop we can expect (save some unforeseen international incident/war) is in the 20-35% range, which is only going to bring the prices back to where they were a few years ago - not back to the good old days when a hard working professional could expect to be able to afford a roof over his/her head.

Hi Andym,

Welcome.

Not sure whether you agree or disagree with a predicted crash?

Some points:

The article was posted by some of lads from ThePropertyPin and love it or hate it these guys do a lot of research - the graph is a well known boom-bust depiction.

Immigration - not sure here myself, but a lot of reports state that many of the immigrants are actually building houses, so....

Urban sprawl - we have the same footprint as Berlin with a 3rd of it's pop. Also when infrastructure catches up most people will not mind living in the baby belt. And don't forget the apartment which are shooting up everywhere - this will bring people closer to the centre.

Small Pop. Don't think that this really counts, except to say that maybe it should be easier to acquire land.

So you say that prices could fall by 20-35%? That would be a crash and I'd be quite happy with a 30% fall.

Hi Janeymackers.

Thanks for the welcome.

I should have been clearer - I do expect a drop in house prices, but I am not sure if I would define a 20% drop as a crash in a market where at least some areas experience higher that 20% increases year in, year out.

Definitely the current trend is not sustainable, but my points were just to back up my own opinion (just a personal one and I am not in the property business in anyway) that the 'crash' will not be a massive massive one, and will still most likely keep single (from a purchasing point of view) professionals like myself out of the market.

On your replies to my points...

Immigration: the number of immigrants employed in other sectors other than construction is vastly under-reported as mush of the work is in the grey or black economy, but they still spend money and so still boost the economy. And a lot are buying here, suggesting they intend staying. they are less likely to leave if there is a crash as they would be tied into their mortgages.

Urban sprawl - Berlin does not compare to Dublin. And the 3rd of the population is backing my point on how much of a sprawl we have - we are using up more space per person is my point. No high rise, etc. Infrastructure is not going to improve at any decent rate. Port tunnel will destroy M50, luas is already reaching passenger capacity, and with the amount of waste in Govt spending what can we expect for the future?

Small pop changes things as the number of units that have to decrease before people see the signs of a 'crash' is much less, (this blog and similar ones already existing now is proof of that) and as people see it coming they hold tight and the crash is not so fast.

I see interest rates as being a bigger cause of a crash tan many of the things mentioned on property sites, as well as esb and gas price hikes. As folks can't afford to live in their 750,000 euro houses they will all want to downsize, and so the first time buyer will still be locked out of the market.

Andym,

Appreciate your comments and do not expect visitors to have any specialist knowledge. I don't.

Immigration - do you know this to be the case?

Berlin -

Accoding to Marc Coleman of the Irish Times "Use of land within the M50 is highly inefficient: In a land footprint the size of Berlin, we are housing less than one third of Berlin's 4 million population. Unfortunately this is where people want to live." http://www.daft.ie/news/2006/daft_report_Q2_2006.daft

Yes, interest rate will be the killer.

Point taken on the pop size

crash with drops of at least 50%

EASILY!

Why?:

25,000 houses for sale Right Now

an increase of 11,000 since june this year

plus the central statistics offices data on 275,000 empty houses PLUS EXTRA 30,000 Holiday homes so as not to be mistaken.

Either way ya swing it its BAD VERY BAD.

very crooked country for us to be charged so much for housing when so many houses are empty

ITS SO WRONG PLAIN AND SIMPLE

Post a Comment

<< Home